If a loved one passes away, you might receive an estate check written out to them and not know how to proceed with depositing it. Examples of estate checks can include tax refunds, final paychecks and interest payments on investments. You can't deposit this kind of check into your own account and will need to get a special bank account in the name of the estate. Key Bank clarifies this requires that you're the appointed executor of the estate and responsible for the various duties throughout the probate process.

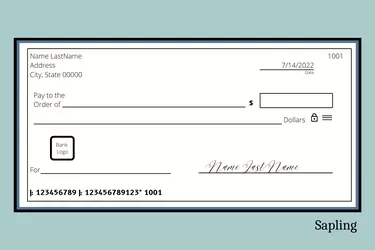

How to Endorse and Deposit a Check Written to an Estate

Video of the Day

Follow these steps to properly endorse the estate check and deposit it into an estate bank account:

Video of the Day

- Have an estate account: First contact the bank or credit union about the requirements for opening an estate account. You'll usually visit in person to complete the application. Bank of America says you'll also provide a copy of the death certificate, any will, letters of administration and possibly other documents. You'll also need an employer identification number for the estate through the IRS. An opening deposit may also be required.

- Make sure the check is eligible: You can only deposit checks that the dead person was entitled to before they passed away. This means that you can't deposit certain recurring government checks or annuity payments and instead will need to contact the issuers and possibly return the payments for reissuance. The Social Security Administration explains this is the case for Social Security checks.

- Endorse the estate check: With the estate account open and the check eligible, you can now endorse the back of the estate check in a way specifying your appointment, explains Cornell Law School. For example, if you're the executor named Jane Doe and the deceased person is John Doe, you could sign, "John Doe by Jane Joe, executor of John Doe's estate."

- Deposit the estate check: Depending on the financial institution, depositing an estate check may require an in-person visit versus the use of an ATM or mobile deposit app. If so, you can expect to complete a deposit slip and provide your photo ID and documentation that you're the estate executor. However, Associated Bank provides ATM cards for estate checking accounts, and this would require selecting the deposit option and inserting the estate check.

Who Can Cash an Estate Check?

The appointed executor or administrator of the estate can cash checks for the estate. According to the New York Bar, the probate court must approve this personal representative, and they may be someone specified in a will, someone chosen by the court if there's no will or someone who chose to take on the position voluntarily. The financial institution will ask for documentation showing this appointment for you to open an estate account.

Frequently Asked Questions About Estate Checks

Here are answers to some common estate check questions.

Can I Cash a Check Made Out to a Deceased Person?

You can't simply deposit a deceased person's check into your personal account or even a joint account you once had with them. However, you can deposit it into the associated estate account as long as you're the approved administrator or executor and have the documentation proving that. You can also discuss other options with the bank or check issuer.

What if There Is No Estate?

Getting an estate bank account is difficult if there's no actual estate, but you can check the specific state law on small estates that don't require probate. A small estate affidavit may apply and allow for the transfer of the deceased assets – including bank accounts – to the named successor. Therefore, your bank might let you deposit the check without opening an estate account.

You can also contact the check issuer to explain the situation. They might reissue the check to you after you submit proof of the person's death and your legal authority to handle the person's financial matters. But if it's a Social Security payment, the check usually needs to be returned as well.

What if There Is No Estate Account?

If there's never been an estate account but the estate is still open, you can follow the process to open one as long as you have the legal authority. If the estate and its bank account have been closed, you may need to petition the probate court to reopen the estate and then ask the financial institution to reopen the estate account. The Wayne County Probate Court mentions you can specify newly discovered assets – such as the check – as the reason for reopening.

What if There Is No Executor of the Estate?

You can submit a request to the probate court to become the executor of the estate via court order. According to the New Hampshire Judicial Branch, you'd need to complete a petition for estate administration. If approved to become executor, you'll take on the associated responsibilities and be able to take the necessary documentation to the financial institution to open an estate account for the deceased person and deposit checks.

- New Hampshire Judicial Branch: Overview - For Petitioner Before Being Appointed By The Court

- Bank of America: Estate Services

- Wayne County Probate Court: Reopening a Decedent Estate

- Cornell Law School: 31 CFR § 240.15 - Checks Issued To Deceased Payees.

- Associated Bank: Estate Checking

- New York Bar: What Is an Executor?

- KeyBank: Do I Need an Estate Account?

- Social Security Administration: If You Are The Survivor