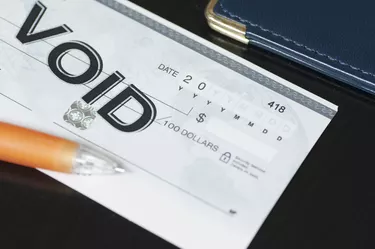

A voided check is one that literally has the word "void" written on the front of the check in large letters, preventing it from being cashed or deposited. You might also enter the word in the amount box on the front of a check and atop the check number, as well as on the payee line and signature line to make your intention clear. You'll want to use permanent blue or black ink.

This is easy enough to accomplish if you want to void a blank check from your checkbook. But it can get a bit more complicated if you don't have a checkbook and paper checks at your disposal.

Video of the Day

Video of the Day

How Do I Get a Voided Check Without a Checkbook?

You'll have to somehow get your hands on another check for your account if you don't have a checkbook. You have a few options for doing so.

Huntington National Bank suggests going to your bank branch and asking the teller to print out a blank check for your account. The teller may even be able to void the check for you. You may be charged a fee for the service.

Depending on why you need a voided check, MyBankTracker indicates that you may be able to use a statement written on your bank's letterhead that provides the same banking information that would be found on your personal check, such as the bank's routing number and your account number.

Your bank account statement might also serve as a substitute for a voided check, again depending on why you need one. Just take care to black-out or obliterate any personal information that you don't want to share, such as your checking account balance.

Common Questions About Voided Checks

Do I Have to Have a Checking Account to Get a Voided Check?

It's highly unlikely that you would need a voided check in the first place if you don't have a checking account. A voided check provides necessary information for electronic transactions to and from an account. A voided check serves no purpose if you don't have an account set up to send or receive money.

Can I Get a Voided Check Online?

Intuit points out that you may be able to download an image of a check if you're set up for online banking with your financial institution. You might be able to print it out and write "void" all over the image, but there's no guarantee that the party that's requested a voided check from you will accept this alternative. You might want to contact them in advance and save yourself the trouble if this option isn't acceptable.

Some mobile apps are set up to actually provide you with a voided check if you want one, according to Current. Explore your account page on your financial institution's app or website and look for a tab that says, "Voided Check." You might find it on a page that's dedicated to your account numbers and other similar information. Whoever has asked you for a voided check might let you submit this electronically instead of giving them a paper check.

What Is a Voided Check Used For?

The National Automated Clearing House Association (Nacha) indicates that voided checks have historically been requested by employers and payroll departments to arrange direct deposit of a worker's paychecks. The check would bear all the account information that's required to electronically send money to your account. You might also have to sign a form for your employer attesting to the information, according to Huntington.

A voided check might also be required for online bill pay, such as if you want to set up recurring, electronic automatic payments to another party. Just be sure not to write "void" over the routing or bank account numbers at the bottom of the check because these are the most necessary pieces of information. You want them to be readable.

What Can I Use if I Don’t Have a Voided Check?

Some employers don't require a voided check. You can simply fill out a form provided to you if you're trying to arrange direct deposit of your paychecks, providing the necessary routing and account numbers and any other information that's required.

You might also ask your bank for a direct deposit authorization form instead. Some banks and credit unions provide these. You may even be able to create such a form online if you've set up internet access to your account.

- Huntington National Bank: How To Void a Check for Direct Deposit

- MyBankTracker: How to Set Up Direct Deposit Without a Voided Check

- Intuit MintLife: How to Void a Check

- National Automated Clearing House Association (Nacha): Direct Deposit Without a Voided Check? Absolutely!

- Current: How Do I Get a Blank or Voided Check?