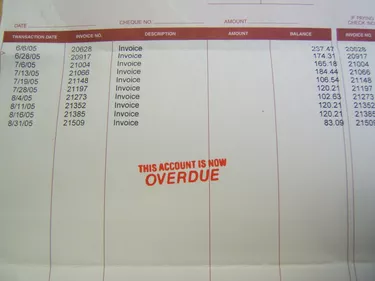

Depending on the company, you may be charged either a flat fee or a financing charge -- and sometime both -- on a late payment. If you don't pay down these late fees and interest charges, they will compound and increase your monthly account balance. Avoid this compounding affect by paying down your balance every month and avoiding high-interest credit cards.

Late Fees

Video of the Day

Companies -- like your credit card company, phone provider, cable company and utilities -- can choose to charge a fee for late payments. Your customer contract should stipulate how much of a late fee you'll be charged. State and federal regulations also limit how much certain companies can change in late fees.

Video of the Day

Financing Charges

In addition to a late fee, the company may charge interest on the unpaid balance on your account. Again, this interest rate should be stipulated in the contract. To calculate your interest charge on a late monthly payment, divide your annual percentage rate -- APR for short -- by 12, and multiply it by your outstanding balance. For example, say that you made a late payment, your outstanding credit card balance is $1,000 and your APR is 12 percent. Your late interest charge would be $1,000 multiplied by 1 percent, or $10.

Compounding Account Balance

If you don't pay your late fee and interest charge within a month after it's charged, it will be rolled into your existing account balance. This means that that you'll pay an interest fee the next month on your balance, in addition to the fees and interest you've already accrued. For example, say you don't pay down the $10 interest charge, the $25 late fee or any of your $1,000 credit card balance. At the end of the month, your new balance would be $1,035. Assuming your APR is still the same, you'll pay a new interest charge of $10.35 --$1,035 multiplied by 1 percent -- along with another late fee.

Avoiding Fees and Charges

Constant late fees, a high APR and a compounding account balance can make it difficult to pay off your debt. Although you may not be able to control the fees charged by your utility company or cable provider, you can choose credit cards that will help you avoid this scenario. Look for credit cards with a constantly low APR and don't keep a balance on your card if you can avoid it. Be wary of credit cards that offer a low introductory rate, then jump up to 15 or 20 percent after a year. If you are late on an occasional payment but you've been a good customer in the past, contact the company and ask for a courtesy waiver of late fees and finance charges.