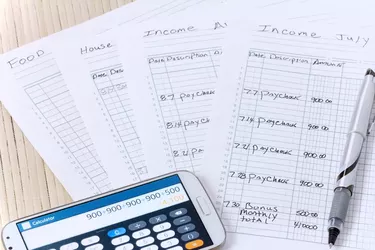

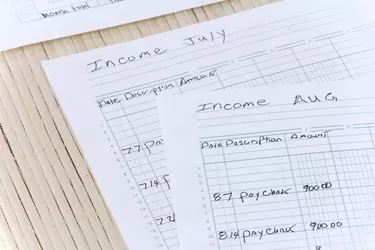

Ledger paper is a classic accounting tool where business owners and accountants record financial figures relating to business transactions. Individuals can use ledger paper to record personal transactions for their home budget. The most common ledger paper format has 6 to 10 columns for information. Columns include date, description, dollar amount and other headers. While ledger paper is not very common anymore with the increasing use of spreadsheets, individuals can use them if they desire to keep paper records for home budgets and financial reports.

Step 1

Purchase several sheets or a booklet of ledger paper. This allows for using ledger sheets for different months, expense groups or the separation of information in a logical manner.

Video of the Day

Step 2

Label each ledger sheet. For example, food, housing, gas, clothing and miscellaneous can be among the categories labeled.

Step 3

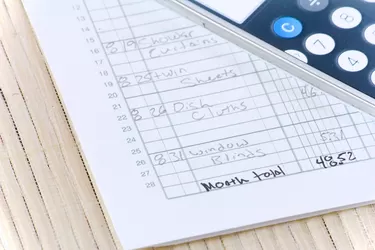

Write down each transaction on the ledger sheet as it occurs. After making expenditures, document the transaction and money spent by putting the date, brief description and dollar amount in the necessary ledger sheet.

Step 4

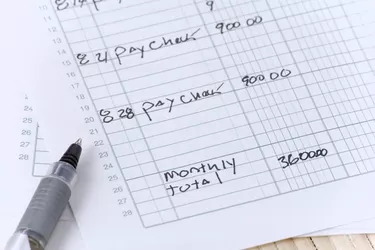

Total each column at month end. Most ledger sheets have several columns for writing down numbers. After each month, draw a line under the last monthly expenditure and write the month's total in the column to the right.

Step 5

Compare all monthly expenses to current monthly income. A separate ledger sheet should contain monthly income for comparison to determine how well the budget system works.

Step 6

Review previous month's ledger sheets to create a future budget for expenditures. This allows individuals to have an idea of expected future expenses from historical records.

Tip

Using ledger paper to create a home budget is a highly customizable process. Individuals can use the sheets in just about any way that best reflects their personal finances.

Warning

Ledger sheets can be lost or destroyed. This will result in lost records and the inability to forecast future expenses or income.

Video of the Day